Using Multiple Corporations

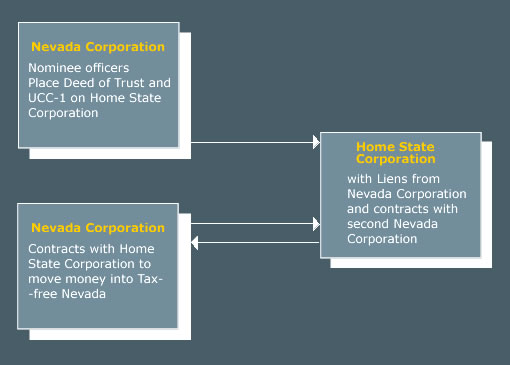

Let’s explore some other possibilities using multiple corporations.

- Set up the corporation in your home state.

- Elect a calendar year ending 12/31 as the end of the tax year for your home state corporation.

- Set up a Nevada corporation electing a fiscal tax year ending 6/30.

- Your home state corporation will only perform the functions that must be performed in that state.

- Transfer every other service such as bookkeeping, management, lease, etc. to the Nevada Corporation, backed up by legal and binding contracts, and with UCC-1 filings in the appropriate state or county recorder’s office.

You have now pledged all your major assets to creditors (your Nevada corporation), so you are virtually dirt poor.

Your home state business owns nothing. Even if an adversary won a judgment against your home state corporation and closed you down, your Nevada Corporation would simply take possession of all assets to which it is legally entitled.

Through this strategy, you have created and filed liens on every tangible asset of your home state corporation and transferred the income to your tax-free Nevada Corporation. Remember, your Nevada Corporation is a separate entity created by law. You have not only eliminated or reduced your state taxes, but you have added another layer of judgment proofing to your strategies.